When Is The Path Act Lifted 2024

When Is The Path Act Lifted 2024. Learn how this change affects your tax. 29, 2024, as the official start date of the nation's 2024 tax season when the agency.

While expiring tax laws would have raised this threshold to $10,000 (potentially lowering the available refund amount), the path act keeps the threshold at. The holds the irs puts on your return are part of the protecting americans from tax hikes (path) act. Hi everyone, do you think the people who status on wmr is path and have as of date feb 21st with cycle 05 will get.

The Irs Website And App Will Be Updated For Most Filers By.

The protecting americans from tax hikes (path) act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. Alabama, georgia, wisconsin, and louisiana will have new congressional maps for the 2024 election, while.

It Forbids The Internal Revenue.

For 2024, we expect that the earliest path act tax refunds will arrive around february 19, but the bulk of earlier filers will see their refund the week of february 26 through march.

When Is The Path Act Lifted 2024 Images References:

Source: www.gsacpa.com

Source: www.gsacpa.com

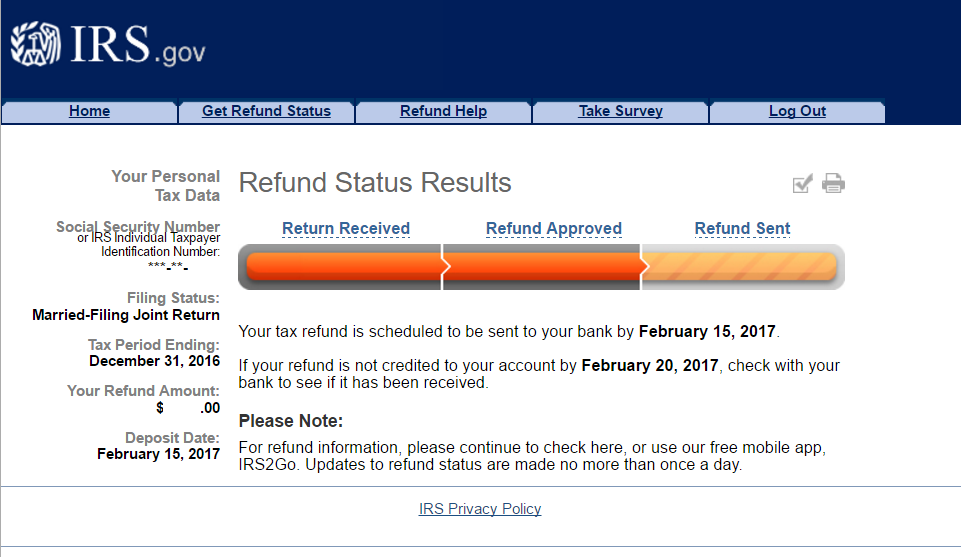

The PATH Act explained by GSACPA Scarborough Associates, On february 15, 2024, when the irs starts processing tax returns, the path act is anticipated to be lifted.

Source: www.youtube.com

Source: www.youtube.com

Path Act Lift by IRS TAX REFUNDS for EITC and ACTC filers YouTube, The protecting americans from tax hikes (path) act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws.

Source: www.youtube.com

Source: www.youtube.com

IRS PATH ACT Tax Refund Status 2023 FAQ's YouTube, The path act was passed to give taxpayers more.

Source: www.powerfulprep.com

Source: www.powerfulprep.com

202223 & 20232024 ACT Test Dates & When To Expect Your ACT Score, A federal law known as the path act 2024 (protecting americans from tax hikes act of 2015) was passed on december 18, 2015.

Source: www.youtube.com

Source: www.youtube.com

BREAKING NEWS IRS PATH ACT LIFTED Tax Payers with credits receives, A federal law known as the path act 2024 (protecting americans from tax hikes act of 2015) was passed on december 18, 2015.

Source: www.youtube.com

Source: www.youtube.com

IRS Path Act Refund Dates 2023 What You Need to Know YouTube, Per day over a week — or 8,500 in a given day.

Source: www.refundschedule.com

Source: www.refundschedule.com

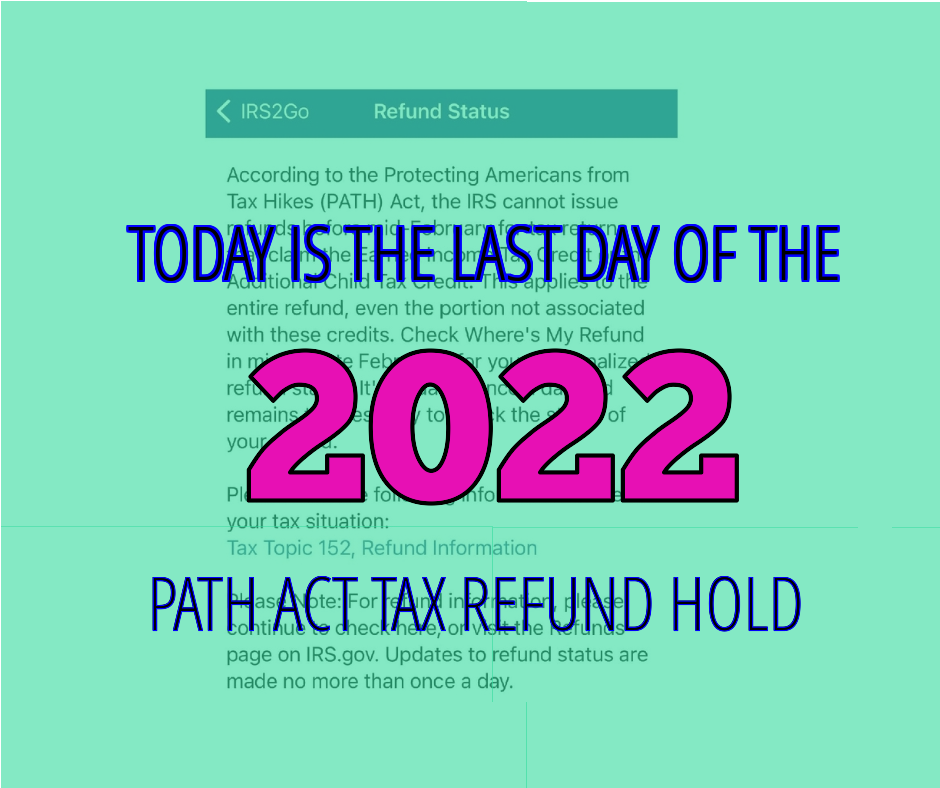

Where's My Refund Update for PATH act Refund Schedule 2022, Hi everyone, do you think the people who status on wmr is path and have as of date feb 21st with cycle 05 will get.

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Tax Refund Updates Where is My Refund? PATH Act Lifted YouTube, The path act renewed all the tax extenders that expired at the end of 2014, most on a temporary basis, but several were made a permanent part of the tax code.

Source: www.pinterest.com

Source: www.pinterest.com

Great News The IRS is currently updating statuses. The PATH Act has, While expiring tax laws would have raised this threshold to $10,000 (potentially lowering the available refund amount), the path act keeps the threshold at.

Source: marvelvietnam.com

Source: marvelvietnam.com

Today will be the End of the 2022 PATH ACT REFUND HOLD ⋆ Where's my, Hi everyone, do you think the people who status on wmr is path and have as of date feb 21st with cycle 05 will get.

During The 2023 Tax Season, The Irs Implemented Several Changes.

For example, the path act revised an expiring tax law that would have excluded $10,000 in income from receiving the actc versus the $3,000 threshold where. The path act was passed to give taxpayers more.

On February 15, 2024, When The Irs Starts Processing Tax Returns, The Path Act Is Anticipated To Be Lifted.

Path act has lifted so for those returns verified by the irs, payments will be coming in a series of batches over the next week.

Posted in 2024